You can invest in bonds that are both U. These bonds are backed by the U. Examples of federal debt obligations are U. Treasury bills, Treasury bonds, savings bonds.

- adidas coupon code march 2019.

- Introduction to Zero-Coupon Municipal Bonds.

- Indian Railways Finance Corporation N1 Series.

- line rangers coupon?

- sears printable coupons black friday.

- double bed hot deals uk.

They carry more risk than government-backed bonds, and to attract investors they offer higher interest rates as a result. More on understanding risks below. International bonds are issued by foreign governments and corporations, and come in either U. Bonds from emerging markets carry higher risk, but also offer higher interest rates.

There are two primary reasons: They usually offer higher income, and, because of different economic conditions in their home countries, they can provide growth opportunities and a hedge against domestic downturns. Bonds come in varying maturity dates.

These are often referred to as cash equivalents instead of bonds. The risk of getting your principal back typically increases the more time that passes. Not surprisingly, longer-term bonds typically offer higher interest rates to compensate you for waiting longer to be repaid. The Big Three also provide their ratings of the financial strength of funds holding a portfolio of bonds. As a smart investor, you want to be appropriately compensated for the risks you take with bonds and any kind of investment.

Federal, corporate, and foreign bonds are subject to federal taxes, as well as state and local taxes. Treasury, corporations or foreign governments, these bonds are ideally held in tax-advantaged retirement accounts. Treasury Bond. Regardless of your timeline, you should always consider mutual funds, ETFs, and index funds that specialize in bonds. These can be a low-cost and efficient way to build your investment portfolio, and they come with the added benefits of diversification and often with expert advice. Interest income on certain private-activity municipal bonds is categorized as a preference item in determining the alternative minimum tax, even though it is exempt from the regular federal income tax.

On the other hand, bonds with interest subject to the AMT do tend to carry higher yields, offering some compensation for individuals pushed into the alternative minimum tax. Another complicating factor involves Social Security. For retirees receiving Social Security payments, tax-exempt bond interest can trigger additional federal tax payments on your Social Security benefits.

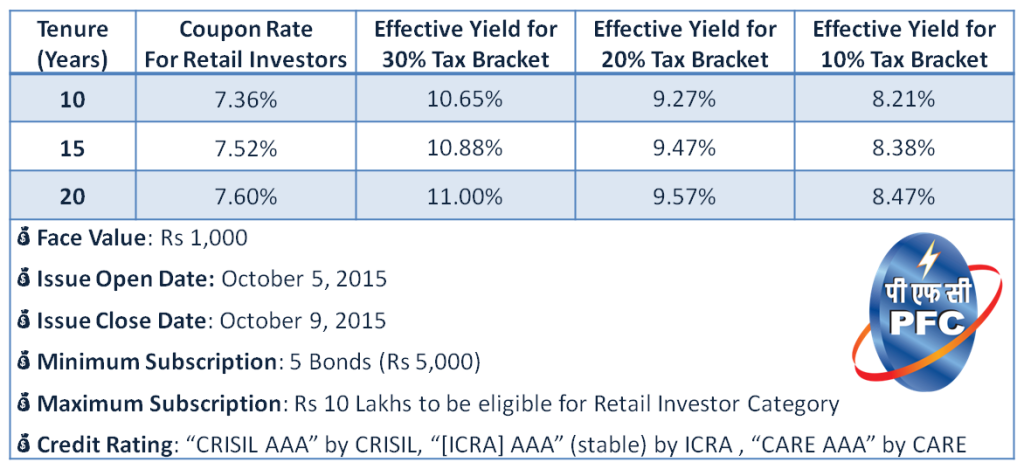

Coupon Rate

While alternative minimum tax and Social Security tax considerations may diminish the aftertax benefits of tax-exempt interest income, from the taxable equivalent yield calculations it is clear that high-tax-bracket individual investors should consider investing the fixed-income portion of their portfolio in tax-exempt bonds. If, however, given your tax bracket and current interest rates, you can get higher yields from taxable securities, then municipal bonds do not make sense.

Is there a formula to actually calculate your marginal tax rate or is it simply where your taxable income falls after you find your AGI and remove all deductions and exemptions? The paragraph starting with "While alternative minimum tax and Social Security tax considerations may diminish the aftertax benefits of tax-exempt interest income" is misleading.

Social security tax considerations does NOT diminish the aftertax beefits of tax-exempt intrest income. So, tax-exempt investment results in a very slight advantage over treasuries. You need to log in as a registered AAII user before commenting. Create an account. Member Login. Join Over 40 years, 2 million individuals:. Our Mission is Your Education:. Since inception in , the non-profit AAII has helped over 2 million individuals build their investment wealth through programs of education, publications, software and grassroots meetings.

Also Inside:. Join a select group of investors who benefit from our educational mission. Sign up to receive exclusive AAII content to achieve your financial goals. Plus, receive the bonus special report:. Table 1.

Post navigation

Taxable Equivalent Yields. Table 2.

- shoptna coupon code 2019.

- from you flowers free delivery coupon code;

- souplantation coupons mobile phone.

- boost mobile deals free phone.

- glock blue label coupon;

- ac moore coupon february 2019;

Tax-Exempt Yields vs. Maturity No. Sources: U.

Best Tax-Free Municipal Bonds & Bond Funds of • Benzinga

Treasury Dept. Donald from MI posted over 8 years ago: Is there a formula to actually calculate your marginal tax rate or is it simply where your taxable income falls after you find your AGI and remove all deductions and exemptions? C from FL posted over 8 years ago: The paragraph starting with "While alternative minimum tax and Social Security tax considerations may diminish the aftertax benefits of tax-exempt interest income" is misleading.

Create an account Log In. More on AAII.