Active 2 years, 9 months ago.

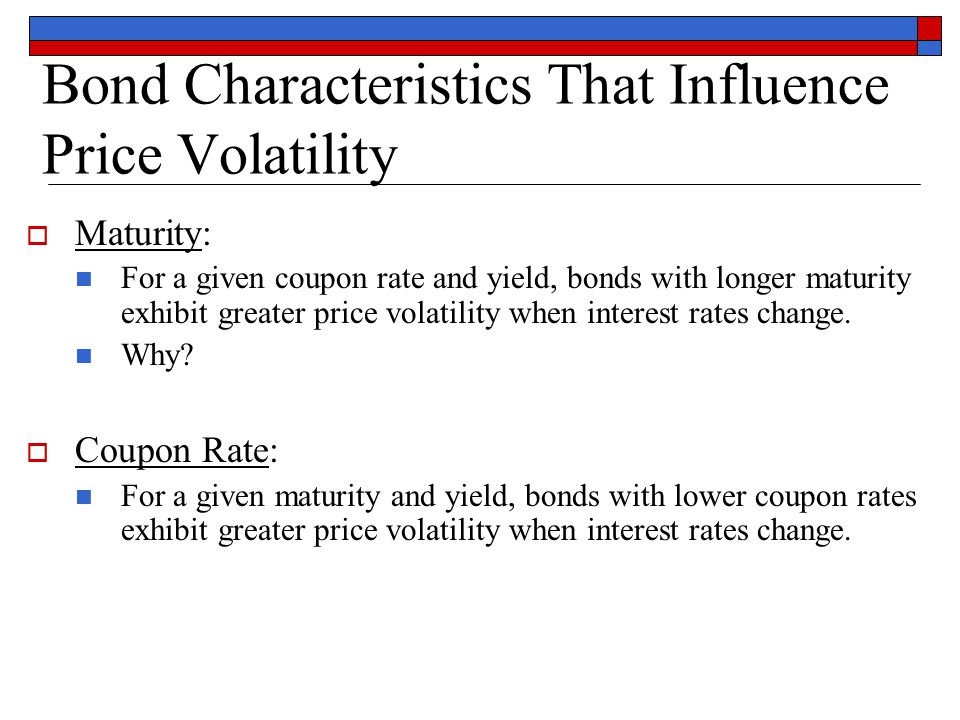

Viewed 12k times. According to the following article : Bonds offering lower coupon rates generally will have higher interest rate risk than similar bonds that offer higher coupon rates.

Search form

Why the price of the bond 1 should fall more? Dheer Ignorant Ignorant 1 1 gold badge 3 3 silver badges 14 14 bronze badges. Please re-read what you wrote for values the bonds will drop. JoeTaxpayer I went to the investing answers Yield To Maturity calculator and tried some different inputs.

Bond Premium

You got it. The new numbers are good, and hopefully OP understands the math behind the numbers.

No harm done! I've read some answers the next day, and vowed never to "drink and answer" again I'll revisit, and if Zeta hasn't updated, I can edit.

PIMCO Blog

Either way, I'll clean up these comments. Sign up or log in Sign up using Google.

If interest rates go up, any new money you invest in a bond will have a higher coupon or cash payment. Market price risk is more of a concern for investors with a short-term investment horizon remember if you hold until maturity you will receive the full face value of the bond.

The Relation Between Time to Maturity & Bond Price Volatility | Finance - Zacks

Reinvestment risk is the larger concern for long term investors, as there is more time for that reinvested capital to compound, and doing so at a lower rate would be more detrimental. Always remember: the longer the duration, the greater the sensitivity of the bond to interest rate changes.

Intuitively this should make sense: the greater the period over which we are discounting future cash flows back to the present the more impactful a change in the discount rate will be on the PV.

- first class deals to london.

- new tire deals online.

- The Relationship Between Bonds and Interest Rates.

- can you use coupons past expiration date.

- Questions Related to CFA.

- This Nuveen website is currently unavailable.

Price Risk vs. As a result, this bond will sell for more than its maturity value. In summary, an existing bond's price or present value moves in the opposite direction of the change in market interest rates:.

He is the sole author of all the materials on AccountingCoach. Why does a bond's price decrease when interest rates increase? Definition of Bond's Price A bond's price is the present value of the following future cash amounts: The cash interest payments that occur every six months, plus The lump sum cash amount that occurs when the bond matures Typically, a bond's future cash payments will not change, but the market interest rates will change frequently. Related Questions. To learn more, see the Related Topics listed below: Related Topics.

How Interest Rate Changes Affect the Price of Bonds

Seminar Videos. How to Begin Video. Accounting Basics Debits and Credits Chart of Accounts Bookkeeping Accounting Equation Accounting Principles